Enterprise Software: Decades of Disruption

The past three decades of enterprise software have been defined by relentless disruption. From the shift to client-server architecture in the 1990s to the rise of SaaS and cloud infrastructure, each wave of innovation has fundamentally altered how businesses consume technology.

This disruption has taken many forms: open-source challenging proprietary models, API-first companies turning business functions into programmable services, and no-code platforms democratizing software development. AI and machine learning are now being embedded throughout the software stack, driving the next wave of change.

Each shift has expanded markets, created new categories, and transformed business operations. The pace is unrelenting, with today's disruptors quickly becoming tomorrow's disrupted. Fueled by billions in venture capital, this cycle of innovation shows no signs of slowing.

Yet, amidst this constant change, one aspect remains curiously static: how this software is implemented and optimized. While products have evolved dramatically, consulting firms have operated in much the same way for decades.

Enterprise Consulting: Decades of Stagnation

For decades, enterprises have relied on the same handful of partners to provide armies of engineers for building, migrating, and maintaining their evolving software infrastructure.

This stagnation is not for lack of frustration. Enterprise executives routinely lament the talent quality, rigid engagement models, and lack of outcome commitment from their consulting partners. In any other market, such dissatisfaction would spark a competitive revolution. Yet in consulting, the incumbents remain entrenched.

Why hasn't disruption touched this sector? Three factors stand out:

Venture Capital Aversion: VCs, ever-eager to fund the next software unicorn, have a near-allergic reaction to service-based business models. This capital constraint stifles innovation in consulting.

Switching Inertia: Consultancies have been entrenched within specific areas of an enterprise, often for decades, with little or no competitive pressure.

Enterprise Bureaucracy: Large organizations have calcified processes that make onboarding new consulting partners a Herculean task, effectively creating a moat for incumbents.

This situation presents a paradox: in an era where software is eating the world, why has the business of implementing that software remained immune to disruption? And more importantly, what would it take to break this stalemate?

Consulting is a Massive Opportunity

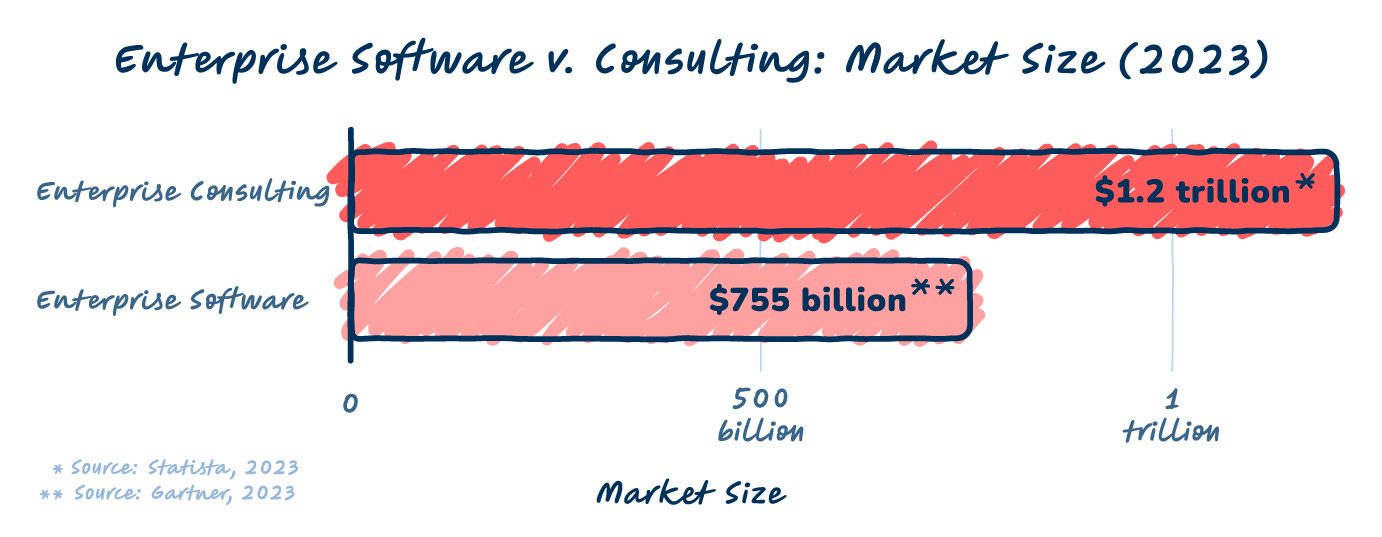

While the tech world obsesses over the latest SaaS unicorn, an even larger market hides in plain sight. This oversight isn't just a minor miscalculation; it's a $1.2 trillion blind spot.

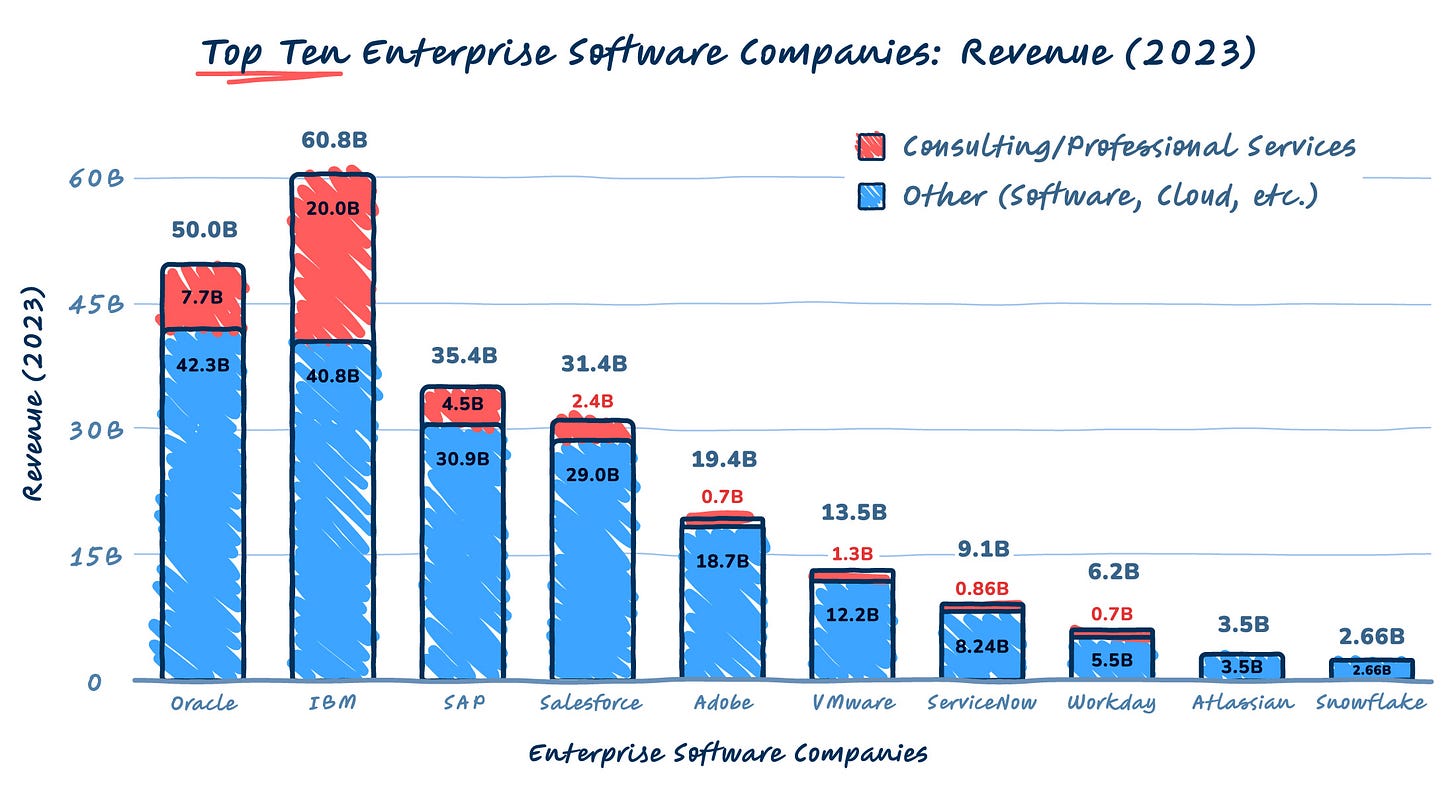

The global consulting market, valued at $1.2 trillion in 20231 dwarfs the enterprise software market, which stood at $755 billion in the same year2. This isn't just a slight edge; consulting outweighs software by nearly half a trillion dollars.

Why this disparity? The answer is deceptively simple: implementing and customizing software almost always costs more than the software itself. Every dollar spent on enterprise software typically demands multiple dollars in consulting to make it operational and effective.

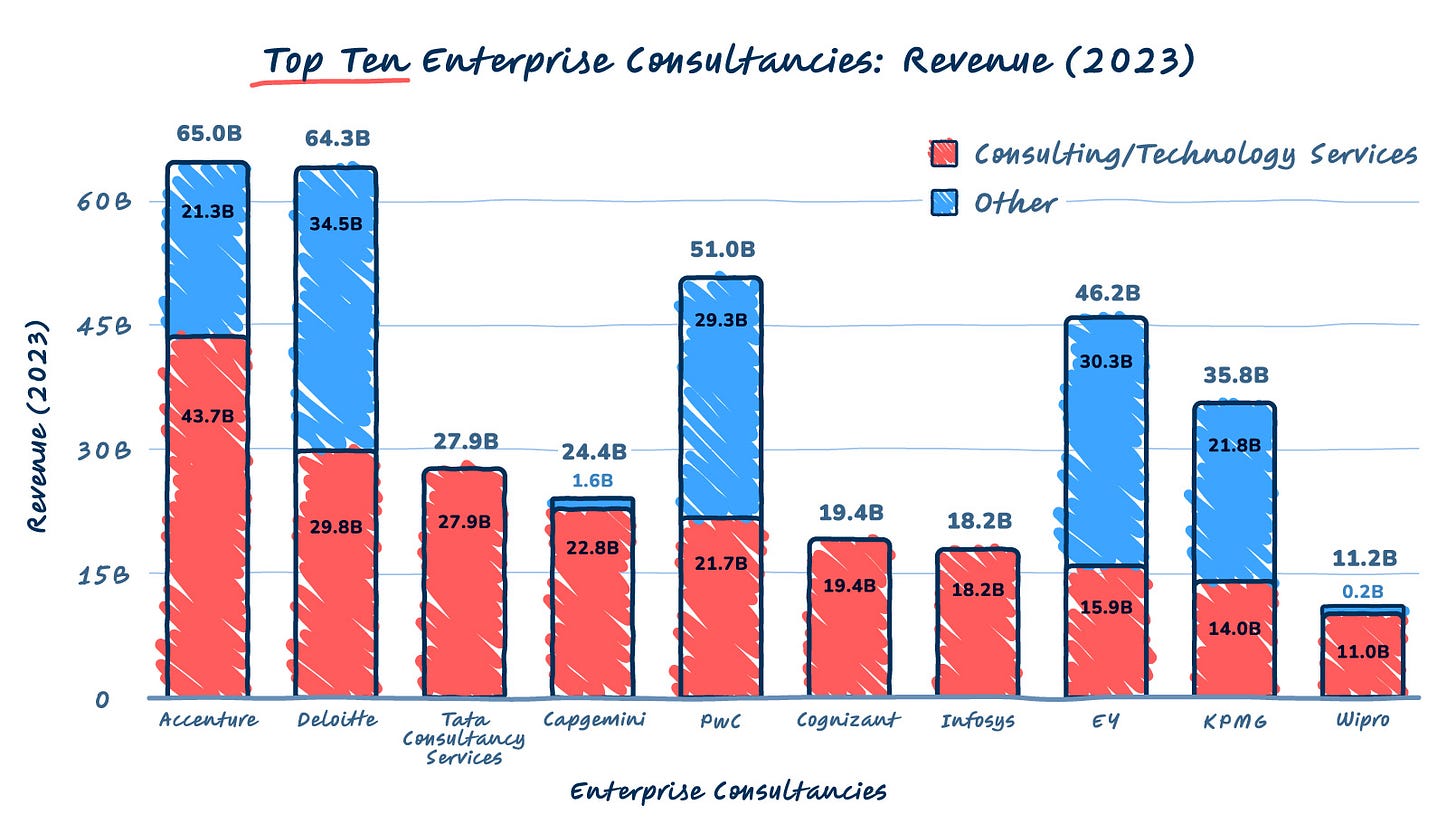

Yet, unlike the software industry, consulting hasn't seen its 'Salesforce moment'. The big players—Accenture, Deloitte, and PwC—continue to dominate, collectively generating over $180 billion in annual revenue in 2023.

Based on venture capital and media interest, you would think the enterprise software market is astronomically larger than the consulting market.

Yet, this is not the case.

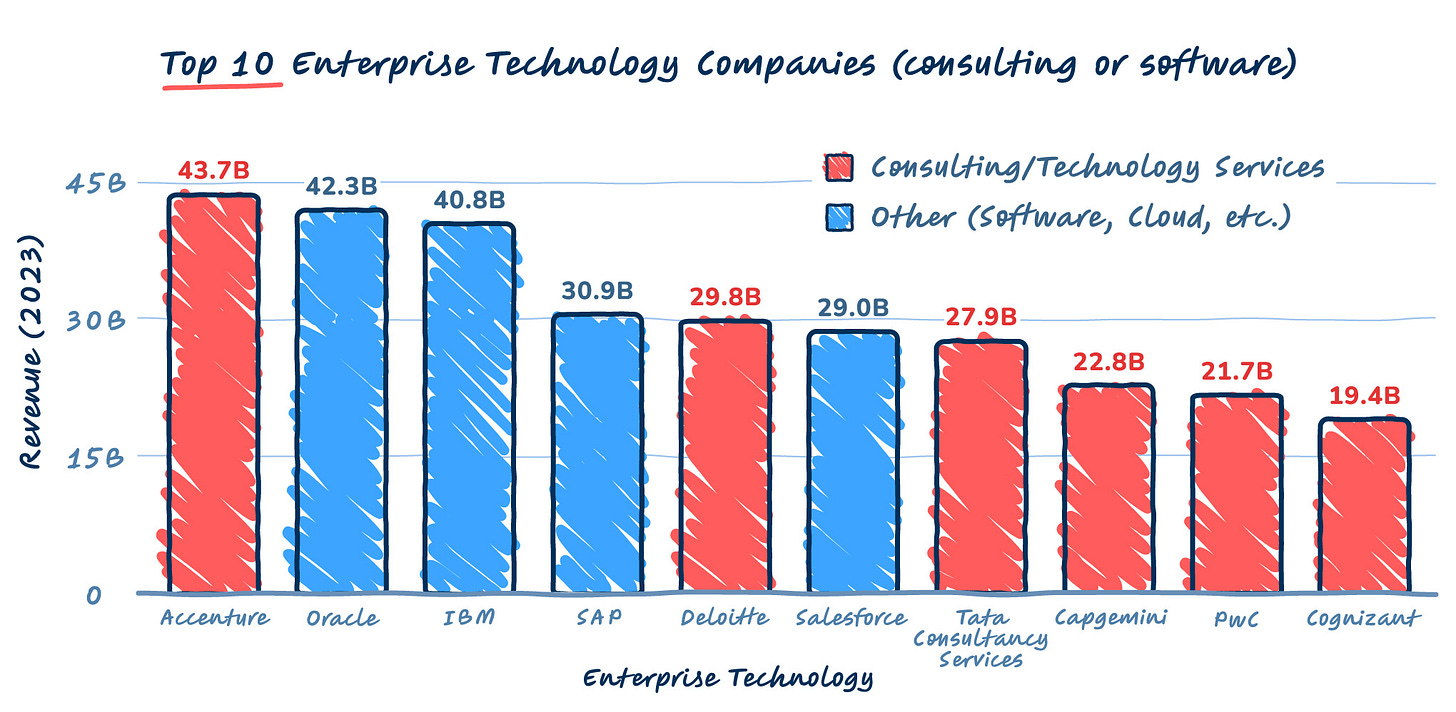

If we combine the charts, we see that the largest consultancies are generally keeping pace with or outperforming their software counterparts, even when we focus solely on tech-related services.

This still underestimates how much the largest consulting companies are outperforming SAAS companies, since it doesn’t take into account non-technical consulting. Every problem will soon be a software problem, which will make the proportion of revenue that consulting companies generate from technology projects significantly larger in the coming years.

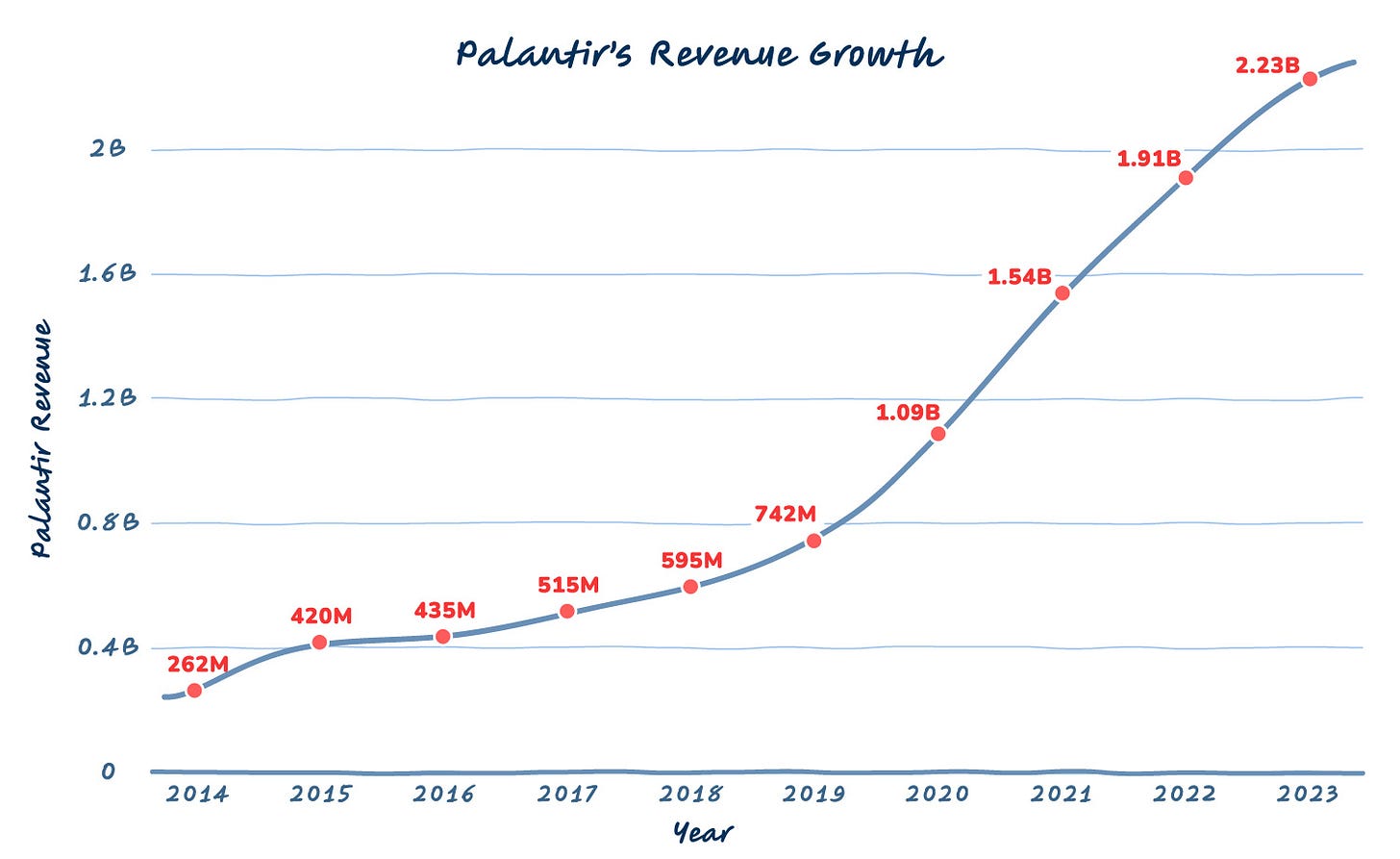

Okay, but a venture capitalist may still argue that an individual software startup has the potential to scale much faster than a consulting company. So let’s take a look at the curious case of Palantir.

Palantir's rapid scaling—from $595 million in 2018 to $1.9 billion in 2022—demonstrates that with the right model, consulting-based startups can scale just as quickly as SAAS startups.

Venture capitalists might argue that Palantir is the exception that proves the rule. I'd counter that Palantir is the exception that proves the opportunity. As one of the few consulting-adjacent companies to receive significant venture funding, Palantir's success suggests that the lack of disruption in consulting isn't due to inherent limitations of the business model, but rather a lack of innovative attempts.

The consulting market isn't just large; it's ripe for disruption. The question isn't whether there's an opportunity, but who will be bold enough to seize it. In a world obsessed with software eating everything, perhaps it's time we took a closer look at who's implementing the software—and how that process itself could be revolutionized.

Overcoming Inertia

Consulting, at its core, is about selling expertise. Firms deploy teams of professionals to solve technical and business challenges. On the surface, this doesn't seem like a business model with a large set of possible permutations. How many different ways can you bill out an engineer?

This apparent simplicity, coupled with several entrenched characteristics, has historically insulated consulting from disruption. Long-term client relationships create high switching costs. Each engagement is customized, making one-size-fits-all solutions difficult. The work often involves sensitive information, creating a high trust barrier for new entrants.

Yet, beneath this veneer of stability, tectonic shifts are occurring. The consulting industry is ripe for a fundamental reimagining of how value is created and delivered.

Service as Software

Enterprises have always known that well-designed custom software will beat a one-size-fits-all solution. The obstacle, of course, is time and cost. However, the nature of software development has changed fundamentally over the past few years, and smaller teams are now able to design and build fairly complex systems. More importantly, AI is already making it possible to build vertical agents that solve problems in ways that code only dreamt about until recently. The trick here isn’t the software, it’s working with third parties willing to roll their sleeves up and understand your processes by working side-by-side with your team.

Palantir's "Forward Deployed Engineer" (FDE) model exemplifies this shift. FDEs aren't just consultants; they're a hybrid of software engineer, data scientist, and domain expert. They don't just advise; they build. This model turns consulting from a purely service business into a software-enabled service - a shift that dramatically increases scalability and value creation.

At Kunai, we launched an AI process automation service earlier this year, focused on helping financial institutions automate back-office processes that formerly required hundreds of people to handle manually.

This is a fundamentally different value proposition.

The Power of Focus: Niche Expertise at Scale

The traditional consulting model prizes generalization. Firms like McKinsey and Accenture cover everything from healthcare to financial services to entertainment. This breadth allows for massive scale - the largest firms employ hundreds of thousands of people. But it comes at a cost: a lack of deep, compounding domain expertise.

Contrast this with a firm like Kunai, which focuses exclusively on financial services. With each implementation, our knowledge compounds. We’ve learned the nuances of taking banks to the cloud, building and customizing core banking systems, and crafting compelling rewards solutions for credit networks and issuing banks. Our engineers don't get shuffled to healthcare or entertainment projects; they deepen their financial services expertise with every engagement.

This focused model creates a virtuous cycle: deeper expertise leads to better outcomes, which attracts more clients in the niche, which further deepens the expertise. It's a model that's harder for generalist firms to compete with, especially in complex, rapidly-evolving industries.

Upping the Talent Bar

Enterprise Vendor Management has long operated on the assumption that talent is interchangeable. Standard rates are set for engineers of a certain level, ignoring the vast differences in expertise and value creation between, say, a full-stack developer working on a simple app and a core banking engineer specializing in a specific module.

This mindset, exacerbated by the outsourcing boom of the 2000s, has led to a race to the bottom in talent quality. It's created an opportunity for challenger consultancies to differentiate by focusing on elite, specialized talent. By focusing on this elite talent and charging accordingly, new consultancies can deliver dramatically more value while still being cost-effective for clients.

Enterprises Must Do Better

For executives at large financial institutions, the desire for better consulting services is often stymied by internal bureaucracy. This isn't just an inconvenience; it's a strategic liability. The current system inadvertently creates an innovation-stifling oligopoly within the enterprise.

Enterprises aren't just passive consumers of consulting services; they're active shapers of the consulting ecosystem. By rethinking internal processes and incentives, enterprises can catalyze a wave of innovation in the consulting industry. This isn't just about getting better services; it's about creating a competitive advantage through more effective, agile, and innovative partnerships.

Streamline Vendor Onboarding

I often tell the story of my last consultancy’s journey to acquisition. We worked with a large American bank for three years as a subcontractor and spent countless hours with executives who wanted to get us a direct contractual relationship. The bureaucratic hurdles were enormous, so much so that when I sold my company to the same bank, we still didn’t have an MSA (“Master Services Agreement”).

It was easier to sell my company to this bank than it was to get an MSA!

This bureaucratic quagmire doesn't just frustrate new entrants; it actively degrades the quality of services across the organization. Entrenched consultancies have no pressure to improve. Pressure your vendor management to create fast-track processes for innovative consultancies, and you will see returns.

Recognize Talent Specialization

In an effort to simplify supplier management, enterprises often enforce standardized rates for varying levels of talent across the organization. This means, inevitably, that the enterprise is overpaying for certain services and underpaying for others. Maintaining a salesforce app is a very different challenge when compared to rewriting a core banking system or launching a breakthrough product. By refusing to recognize this, enterprises are making it difficult for their partners to bring in elite talent for elite challenges.

There are often creative ways to get around this at most enterprises, but that shouldn’t be required. There should be an understanding about the variability of challenges that is built into the system itself. Executives should put pressure on supplier management to make it possible to work within the system and still get the talent that they need.

Realign Incentives

When you have successfully onboarded more vendors and increased the range of specializations you can support, it is time to start thinking about contracts that better serve the interests of your enterprise. Large consultancies have managed to become very inflexible about engagement models over the years, primarily because they are so entrenched. You should be able to convert consultants into FTEs after a certain threshold period. You should be able to penalize your partners for consistently subpar talent. You should be able to demand terms that incentivize your partner to deliver and ship, rather than incentivize them to get a contract renewal.

When there's genuine competition for your business, consultancies will be more open to these terms. The goal isn't to squeeze your partners, but to create win-win scenarios where their success is directly tied to the value they create for you. This approach does more than improve individual engagements; it shapes an ecosystem of consultancies that are more innovative, accountable, and aligned with your business objectives.

The Consulting Revolution

The consulting industry stands at a crossroads, much like enterprise software did two decades ago. The ingredients for disruption are all present: a massive market ripe for innovation, emerging technologies that can dramatically enhance service delivery, and growing dissatisfaction with the status quo. The question isn't whether consulting will be disrupted, but who will lead this transformation and reap the rewards.

For both consultancies and their enterprise clients, the imperative is clear: embrace change or risk irrelevance. Innovative consultancies that combine deep domain expertise, elite talent, and software-enabled services stand to capture enormous value. Meanwhile, enterprises that actively reshape their vendor relationships and internal processes will gain a significant competitive advantage. In the end, this isn't just about better consulting services; it's about unlocking new levels of enterprise agility and innovation. The consulting revolution is coming, and it promises to be as transformative as the software revolution that preceded it.

The only question that remains is: who will write the next chapter in this $1.2 trillion story?

Statista, 2023

Gartner, 2023