Finance

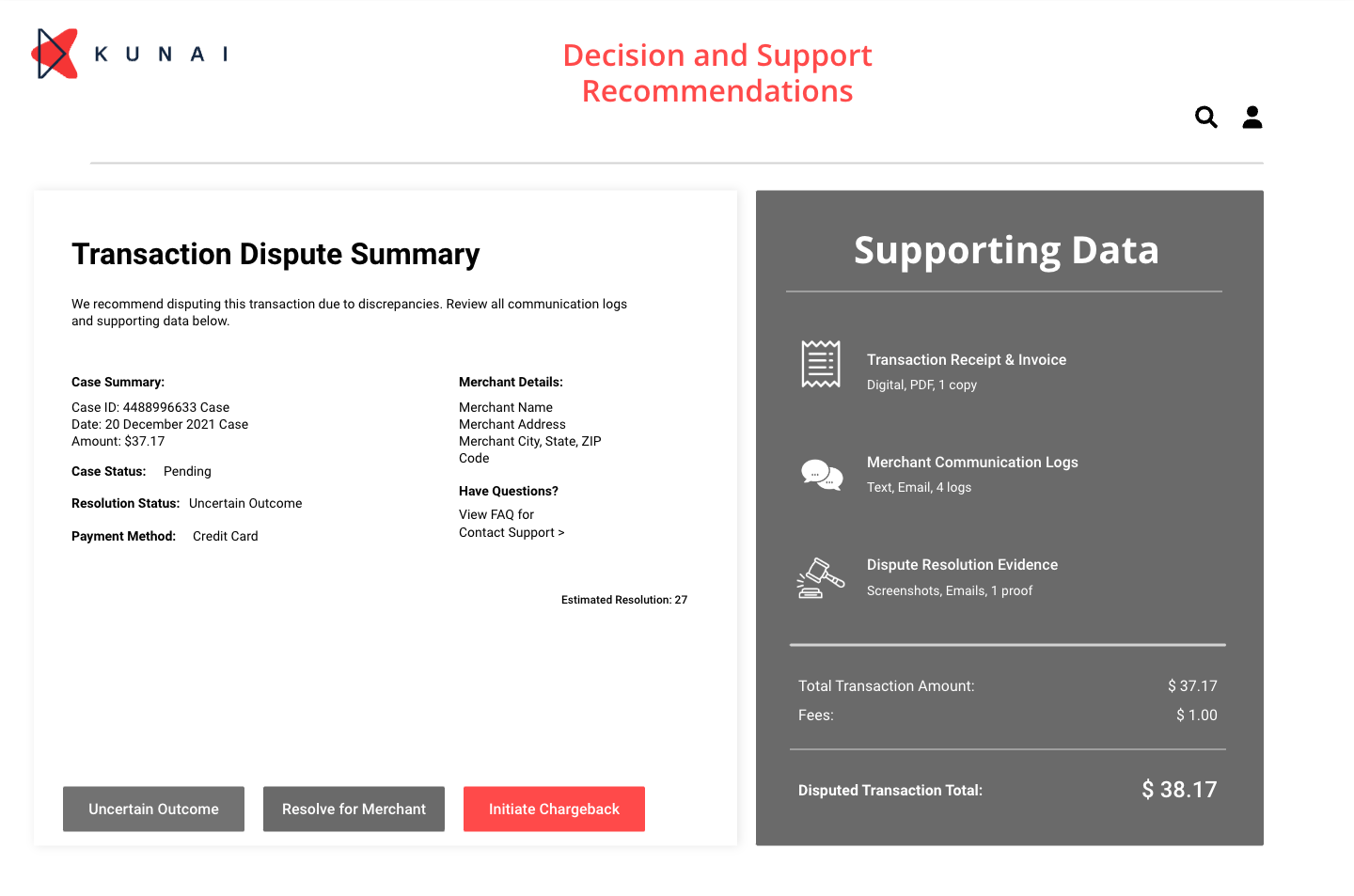

Credit Card Dispute - Decision and Support Recommendations

Inspiration

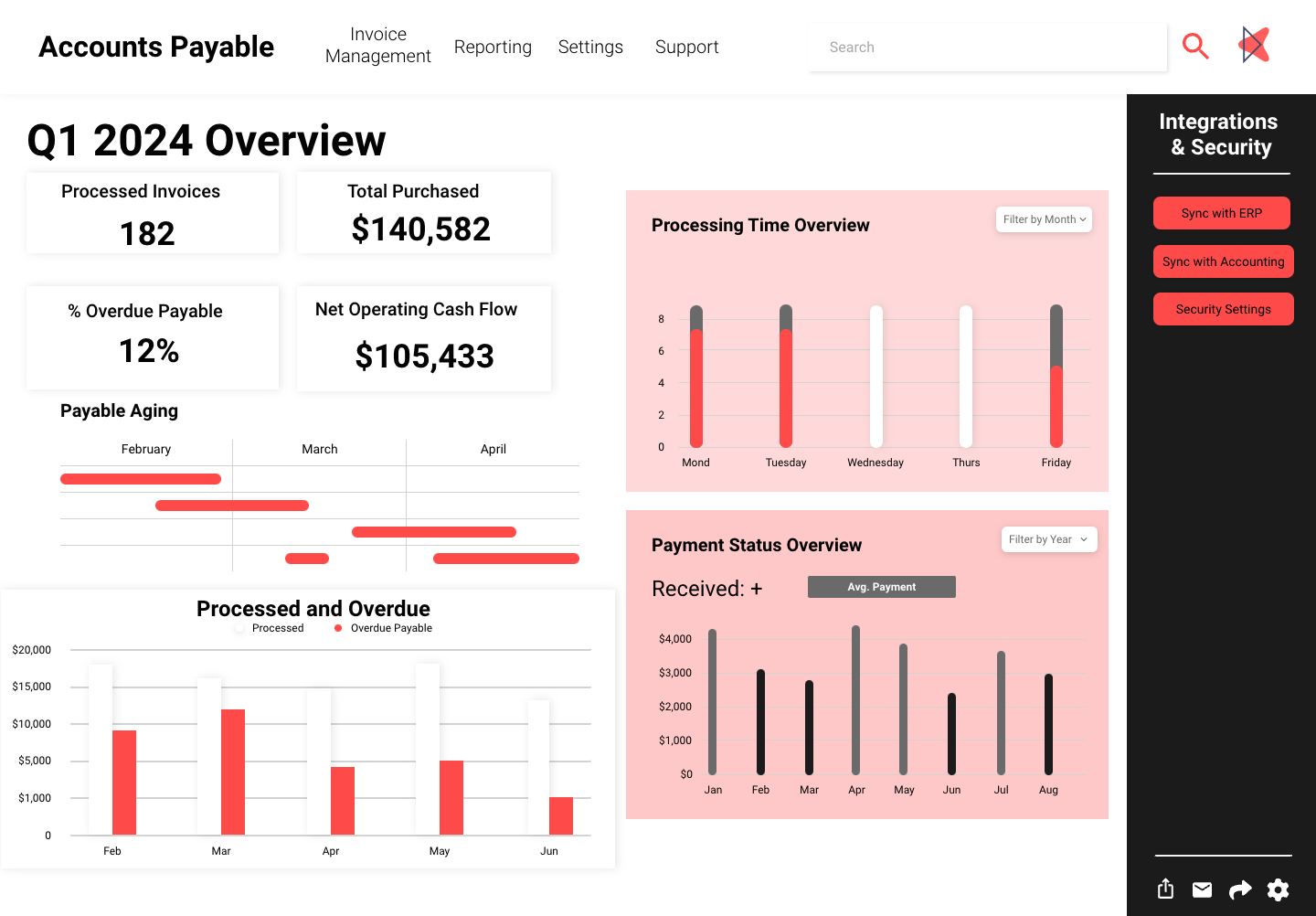

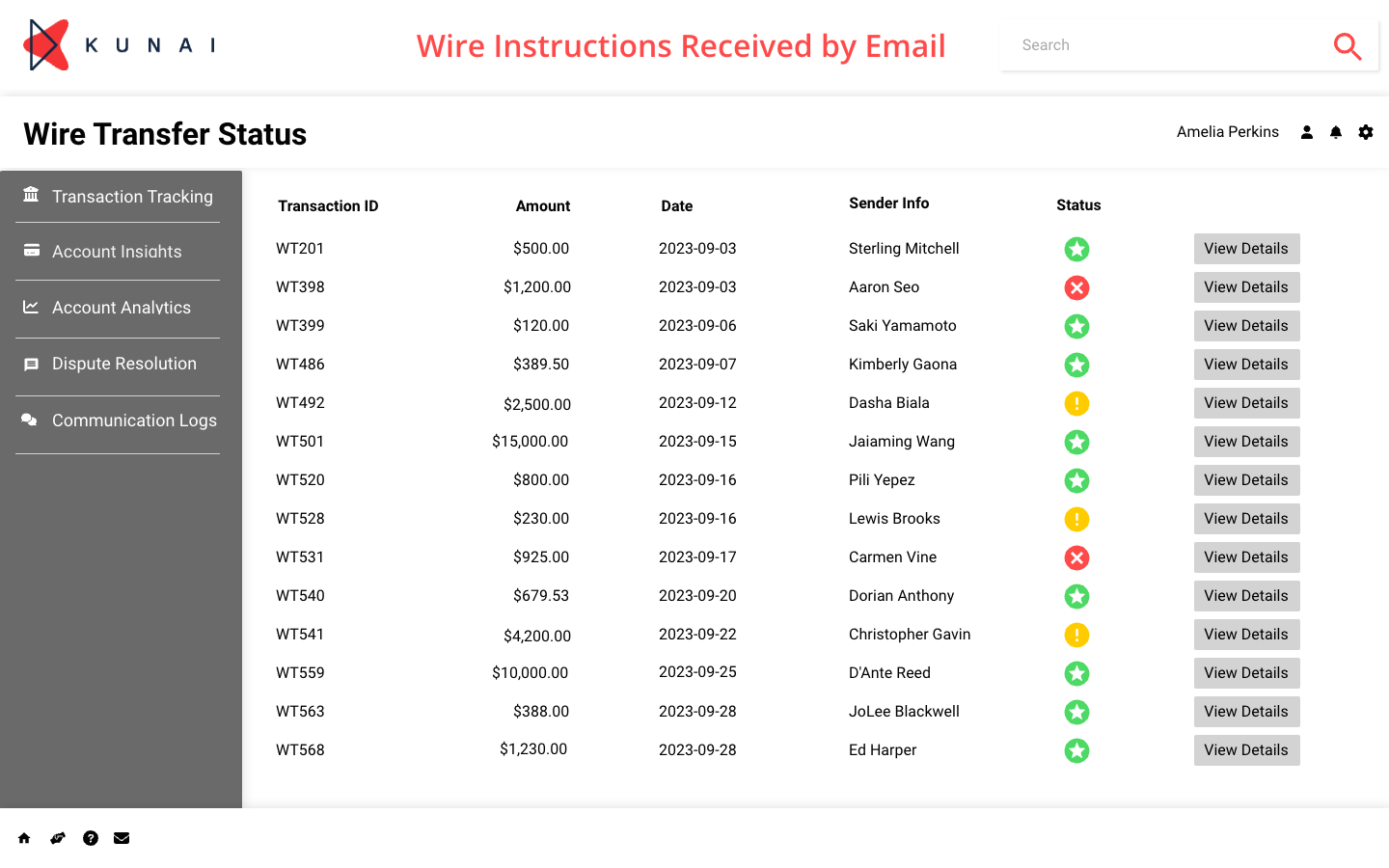

Credit card disputes typically begin when a cardholder identifies a transaction on their credit card statement that they believe is incorrect, unauthorized, or fraudulent. The dispute process can take several weeks or even months, depending on the complexity of the case and the response time of the merchant. During the investigation, the cardholder and the issuing bank may need to assemble additional information or documentation to support the claim.

Opportunity

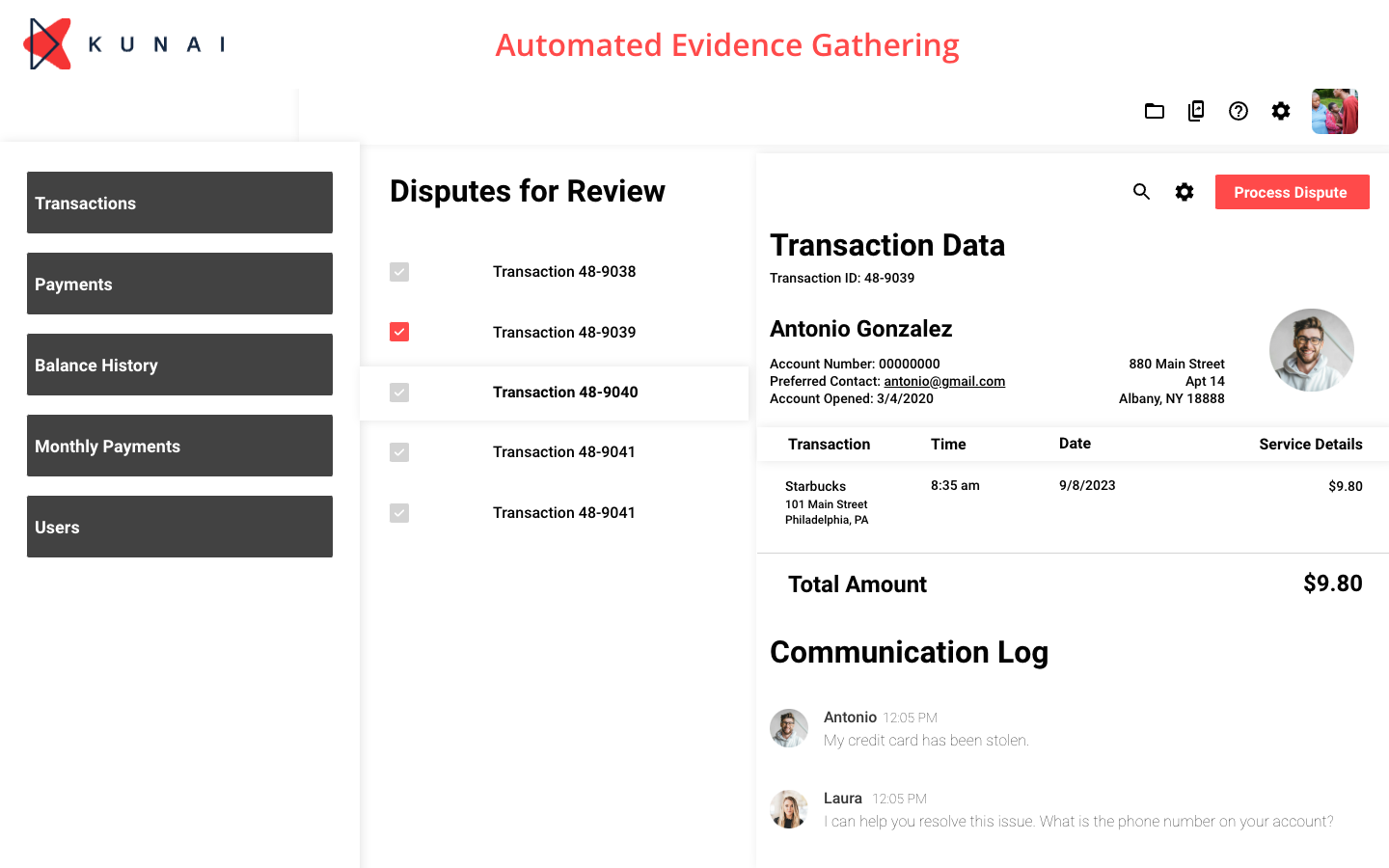

Kun.AI can be used to provide decision support for banks by analyzing the submitted evidence against a repository of resolved cases. This can help in determining the likelihood of successful dispute resolution. The decision would ultimately land with a human for review, but the accuracy of decisions made by issuing banks can be optimized and improved, thereby reducing the need for further arbitration.

Kun.AI Process Automation

After a credit card dispute’s data and initial correspondence has been collected, Kun.AI can review the data and make an initial informed recommendation for how the bank could proceed with the dispute. If the merchant accepts the dispute, there is nothing more to do. Otherwise, the collected data and Kun.AI’s recommendation would be presented to a human employee of the bank to make the final decision about how to proceed.