Finance

Credit Card Dispute - Automated Evidence Gathering

Inspiration

Credit card disputes typically begin when a cardholder identifies a transaction on their credit card statement that they believe is incorrect, unauthorized, or fraudulent. The dispute process can take several weeks or even months, depending on the complexity of the case and the response time of the merchant. During the investigation, the cardholder and the issuing bank may need to assemble additional information or documentation to support the claim.

Opportunity

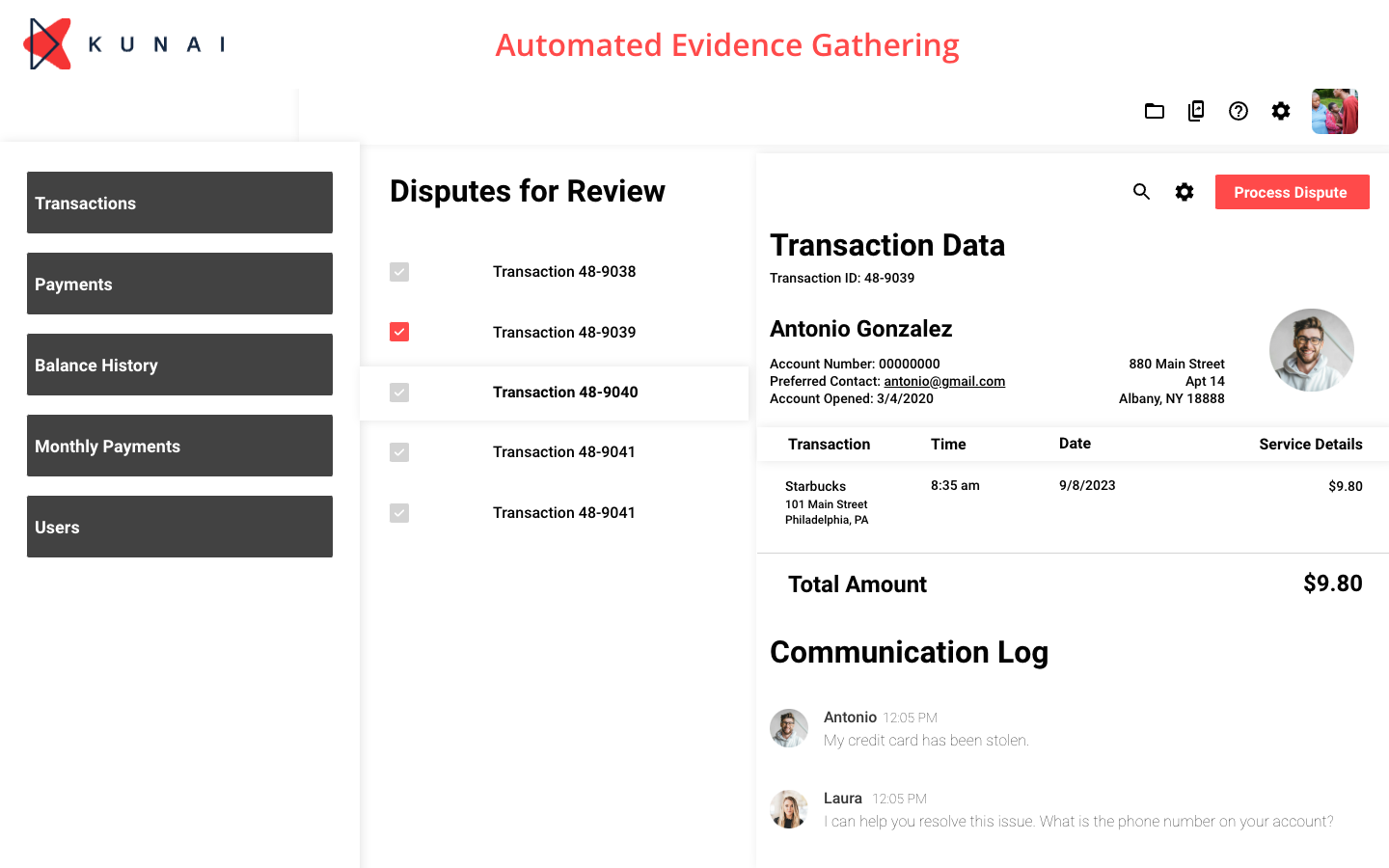

Use Kun.AI to automatically gather and compile relevant transaction data, communication logs, and other required documentation. This reduces the manual effort for merchants and banks, speeds up the dispute resolution process and minimizes errors associated with manual data collection.

Kun.AI Process Automation

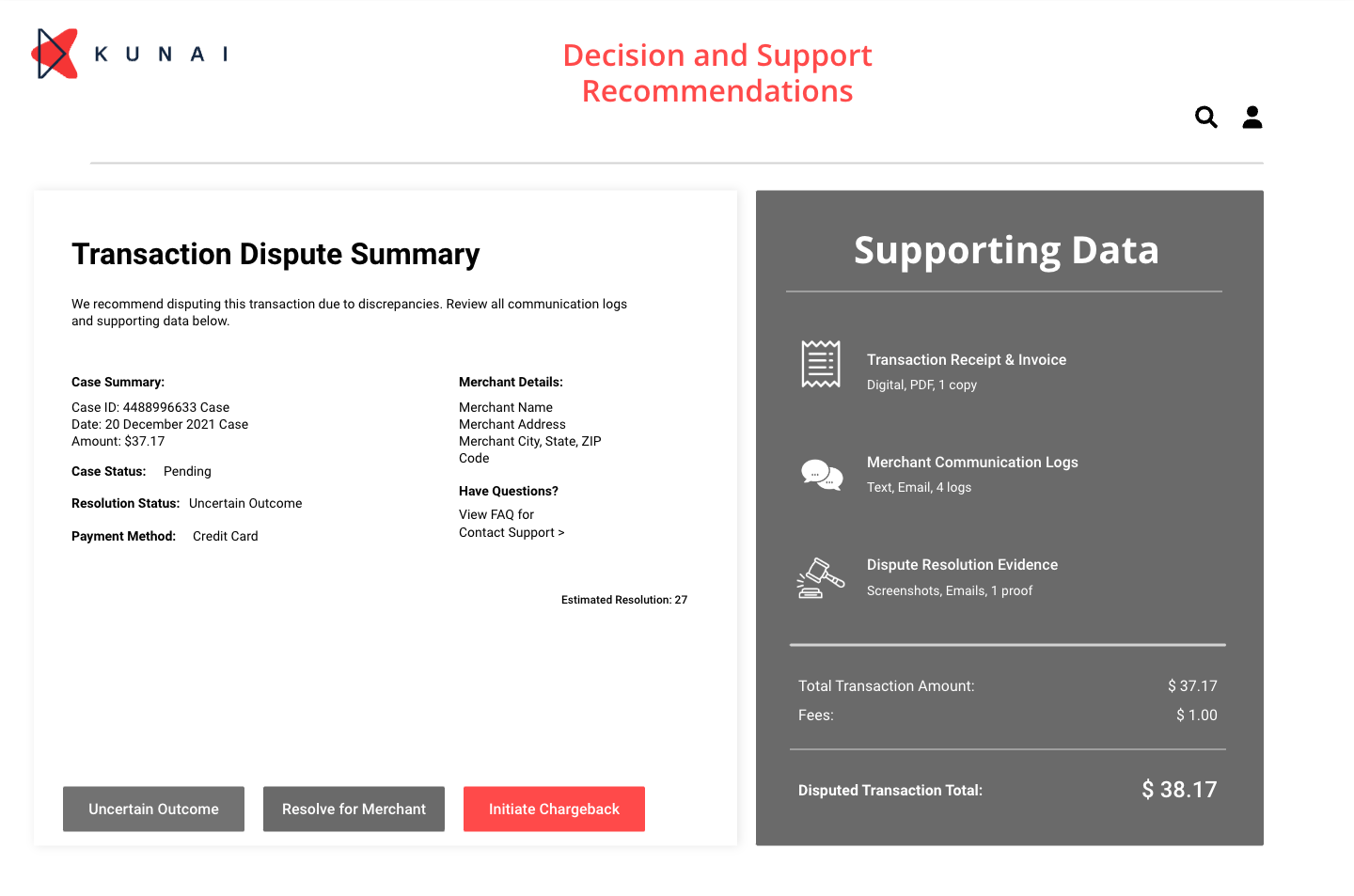

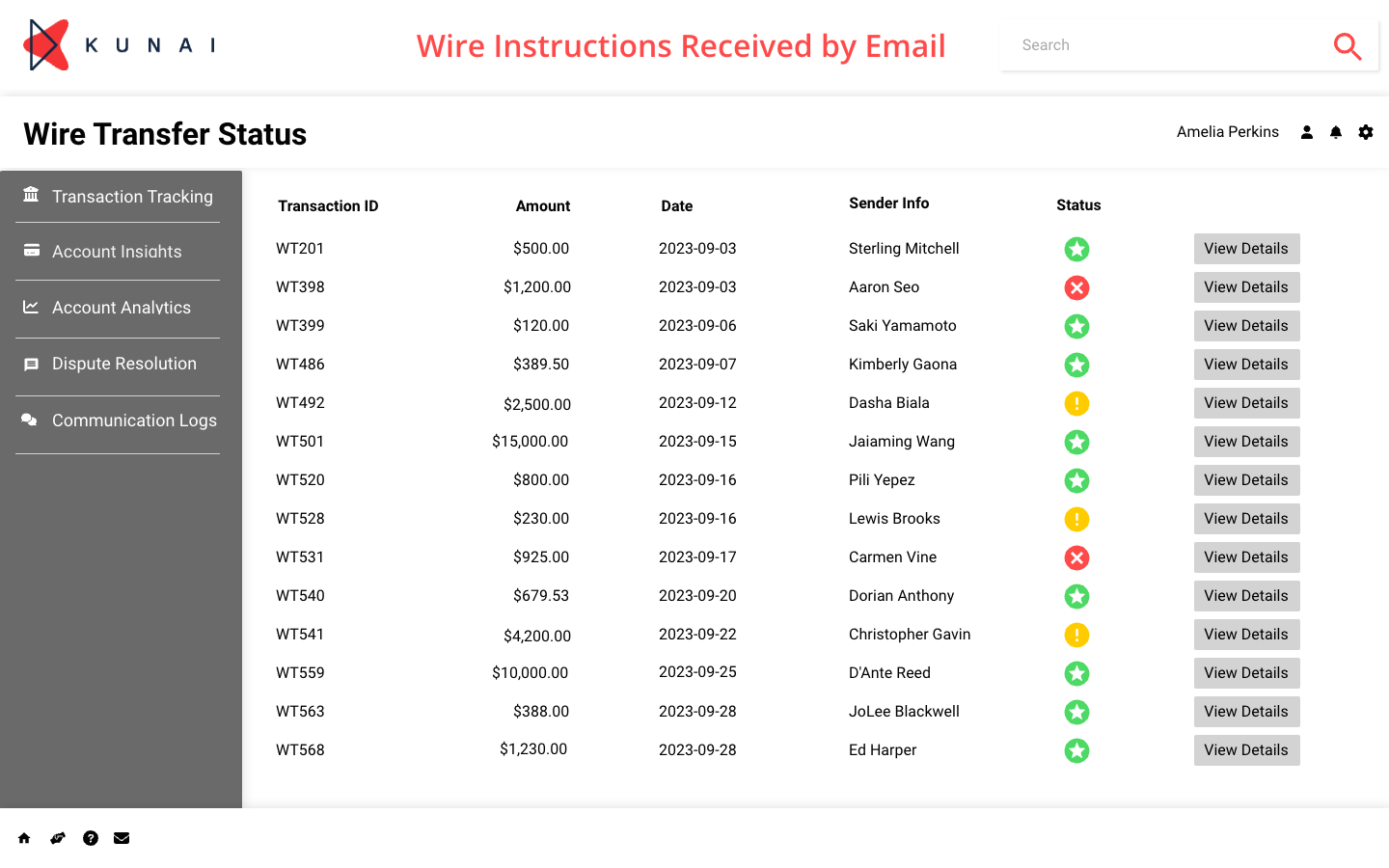

When a dispute is initiated by a customer, Kun.AI can be used to automatically gather necessary documents and data from the bank's various associated data sources such as databases, emails, and external APIs.

The data can be organized chronologically, or according to relevance to the case, and packaged neatly for review and/or to be sent as evidence to the merchant or acquiring bank for review. As the dispute progresses, Kun.AI can also keep track of the communication logs to be compiled as part of the evidence documentation package.

Automation Flow

Let's talk about your next big project

Get in touch with our tech and product experts to discuss a new project or learn more about our services.

Copyright © 2024 Kunai Co. All rights reserved.